- (877) 699-1801

- info@divinepathfinancial.com

- Helping You Get The Most Out of Life.®

Follow Us On:

- Home

- Who We Are

Embrace Your Future with Divine Path Financial Group!

Living Benefits Case Studies

Strengthening Communities Through Faith and Action

What is Your Divine Path To Financial Freedom?

- What We Offer

- Tax-Free Retirement

- Living Benefits

- Estate Planning

- The Beneficiary Liquidity Plan®

- Infinite Banking

- Fixed Indexed Annuities

- Premium Financing

- IUL for Kids

- Mortgage Protection

- Business Planning

- Voluntary Employee Benefits

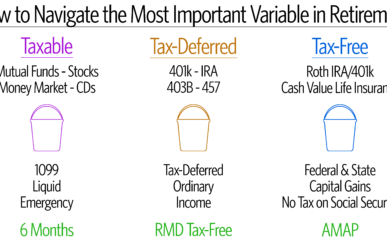

Planning for retirement can be overwhelming, when it comes to taxes.

Living Benefits are the new kind of life insurance. In short, it's life insurance you don't have to die to use.

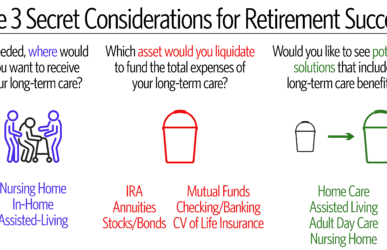

Legacy planning goes beyond determining who gets what after you are no longer here.

With a (BLP), you can allocate existing funds to help cover expenses your family is likely to incur in the months following your passing.

Learn how Infinite Banking uses permanent cash-value life insurance policies to grow money in a tax-advantaged way.

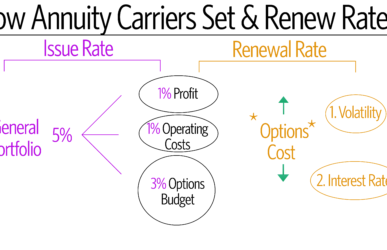

Unlock Financial Stability and Growth with Indexed Annuities

Premium finance is a strategy in which a policyholder borrows from a third-party lender (a bank) in order to pay large life insurance premiums on a large policy.

As parents, we all love and want what's best for our kids. This includes wanting the best for their future financially.

If you own a home and are currently paying off a mortgage, you should have mortgage protection life insurance in place, also known as home life insurance.

Planning and Protection for Business Owners

Our partnership with Colonial Life provides critical support to employees when the unexpected happens — whether it’s an accident, illness or injury.

- Resources

- Contact Us