Estimated reading time: 5 minutes

Retirement is an exciting milestone—it’s the period you’ve worked so hard to reach, but navigating it can feel overwhelming. No two retirements are alike, with different savings, family situations, and personal goals shaping each one. Despite the variations, there’s one critical variable that everyone must manage: taxes.

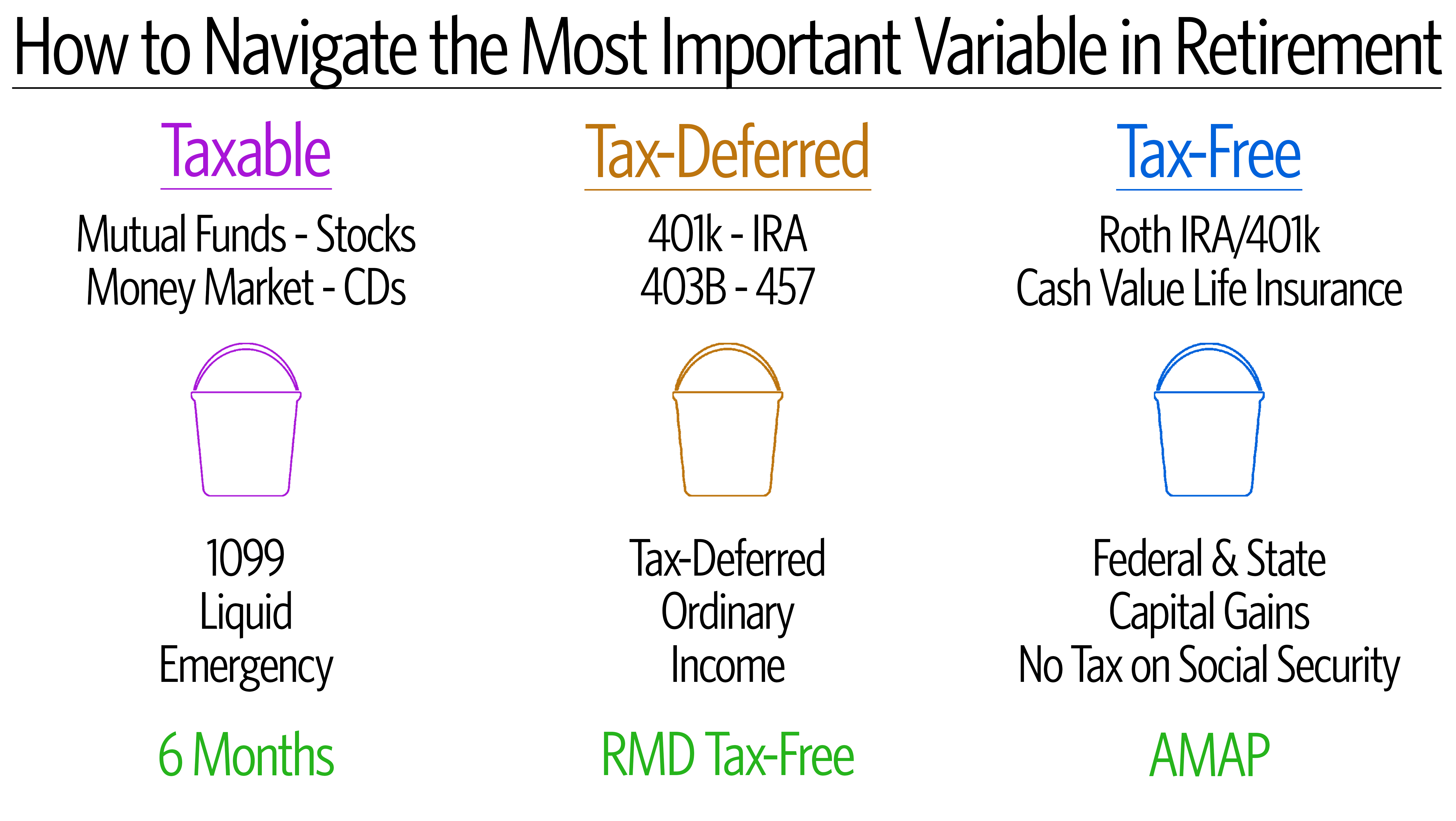

Taxes can make or break your retirement plan. Think about it: our country was founded on resisting taxes, and now, as you approach retirement, it’s no surprise that you’d want to minimize the amount of taxes you pay. In this blog, we’ll explore three key “buckets” for managing your retirement money: the taxable, tax-deferred, and tax-free buckets, all while keeping two core principles in mind:

- If there’s a tax you don’t have to pay, avoid it.

- If you must pay a tax, pay as little as possible.

The Taxable Bucket

This bucket holds investments like mutual funds, stocks, money market accounts, and CDs. How can you tell if an investment belongs here? If you receive a 1099 form at tax time, it means you have to pay taxes on the interest earned annually. That’s why these are called taxable accounts.

While paying taxes on these accounts is a downside, the upside is liquidity. This bucket is perfect for your emergency fund, since it allows easy access to cash. Financial experts agree that you should have around six months’ worth of savings in this bucket for emergencies.

But here’s where it gets tricky: Can you have too much money in this bucket? Yes. If you exceed what’s needed for emergencies and continue to invest in taxable accounts, you’re unnecessarily paying taxes every year. So, once you’ve secured your emergency fund, it may be time to shift additional savings elsewhere to avoid excess taxation.

The Tax-Deferred Bucket

Next, we have the tax-deferred bucket. This includes popular accounts like 401(k)s, IRAs, 403(b)s, and 457 plans. In these accounts, you delay paying taxes until you withdraw the money, which is why this bucket is key to managing taxes in retirement. The principle here is simple: if you have to pay taxes, let’s defer them and pay as little as possible.

Many people’s retirement savings are primarily in tax-deferred accounts, but here’s the catch: eventually, you will pay taxes. Whether you decide to withdraw funds in retirement or leave the money to your heirs, taxes will be due. Withdrawals from these accounts are treated as ordinary income, meaning they’re added to any other income you earn and taxed accordingly.

This makes your future tax situation highly unpredictable. Why? When you retire, you might lose two key deductions: your children (as dependents) and your mortgage interest (if your home is paid off). On top of that, tax brackets may change over time. This uncertainty is why planning for taxes on your tax-deferred accounts is so important.

One strategy to consider is managing your required minimum distributions (RMDs), which the government mandates you take once you reach a certain age. The goal is to minimize the taxes you owe on these RMDs through careful planning and coordination with your financial advisor.

The Tax-Free Bucket

Finally, let’s talk about the tax-free bucket—the most desirable bucket of all. The money in this bucket won’t be subject to federal, state, or capital gains taxes. It also doesn’t impact taxes on your Social Security benefits. Given that up to 85% of Social Security income can now be taxed, this is a crucial consideration.

Accounts in this bucket include Roth IRAs and Roth 401(k)s. These are great tools, but there are limits to how much you can contribute annually, and some high-income earners may not qualify for Roth IRAs at all. That’s why it’s essential to max out these contributions as much as possible.

Another powerful vehicle for tax-free growth is cash value life insurance. While not as commonly discussed, this type of policy allows you to grow your money tax-deferred and withdraw it tax-free, making it a valuable part of your tax-free bucket strategy.

The rule here is simple: put as much money as possible (AMAP) into the tax-free bucket. This will allow you to withdraw money in retirement without worrying about additional taxes, letting you preserve more of your wealth and enjoy a higher quality of life.

Navigating Taxes in Retirement

To recap, your taxable bucket should hold six months’ worth of emergency savings. Anything beyond that, and you’re likely paying more taxes than necessary. In the tax-deferred bucket, like your 401(k)s and IRAs, taxes are inevitable, but careful planning can minimize the hit when you retire. Finally, aim to fill the tax-free bucket with as much money as possible to ensure your wealth grows and is withdrawn without the burden of taxes.

The most important takeaway? Work with a financial professional to craft a tax strategy that protects your hard-earned savings. Taxes are one of the most significant variables in retirement, but with proper planning, you can navigate them and enjoy the retirement you deserve.

Conclusion

Managing taxes is one of the biggest challenges in retirement, but by understanding the role of the taxable, tax-deferred, and tax-free buckets, you can significantly improve your financial outcomes. Don’t leave your tax strategy to chance—speak with a qualified advisor who can help you implement these principles and minimize your tax burden in retirement.

By following these guidelines, you can make taxes a smaller part of your retirement picture and focus on what really matters: enjoying the fruits of your labor and spending time with those you love.

Thank you for joining me today. I encourage you to reflect on what we’ve discussed and partner with a trusted advisor to map out your financial path. I look forward to seeing you next week for another episode of Money Script Monday.

Related Links