Estimated reading time: 3 minutes

Hey there, I’m Kyle Tomko, and I recently had the chance to dive deep into how annuity carriers set and renew rates. This topic is timely, especially with today’s fluctuating interest rates and the growing attractiveness of annuity products. In fact, this post stems from a recent case where a client asked me about the future stability of cap rates on a fixed index annuity product. That question really got me thinking, and today, I want to help you understand the process behind how carriers set these rates—and more importantly, how they change over time.

Let’s break it down.

How Initial Rates Are Set

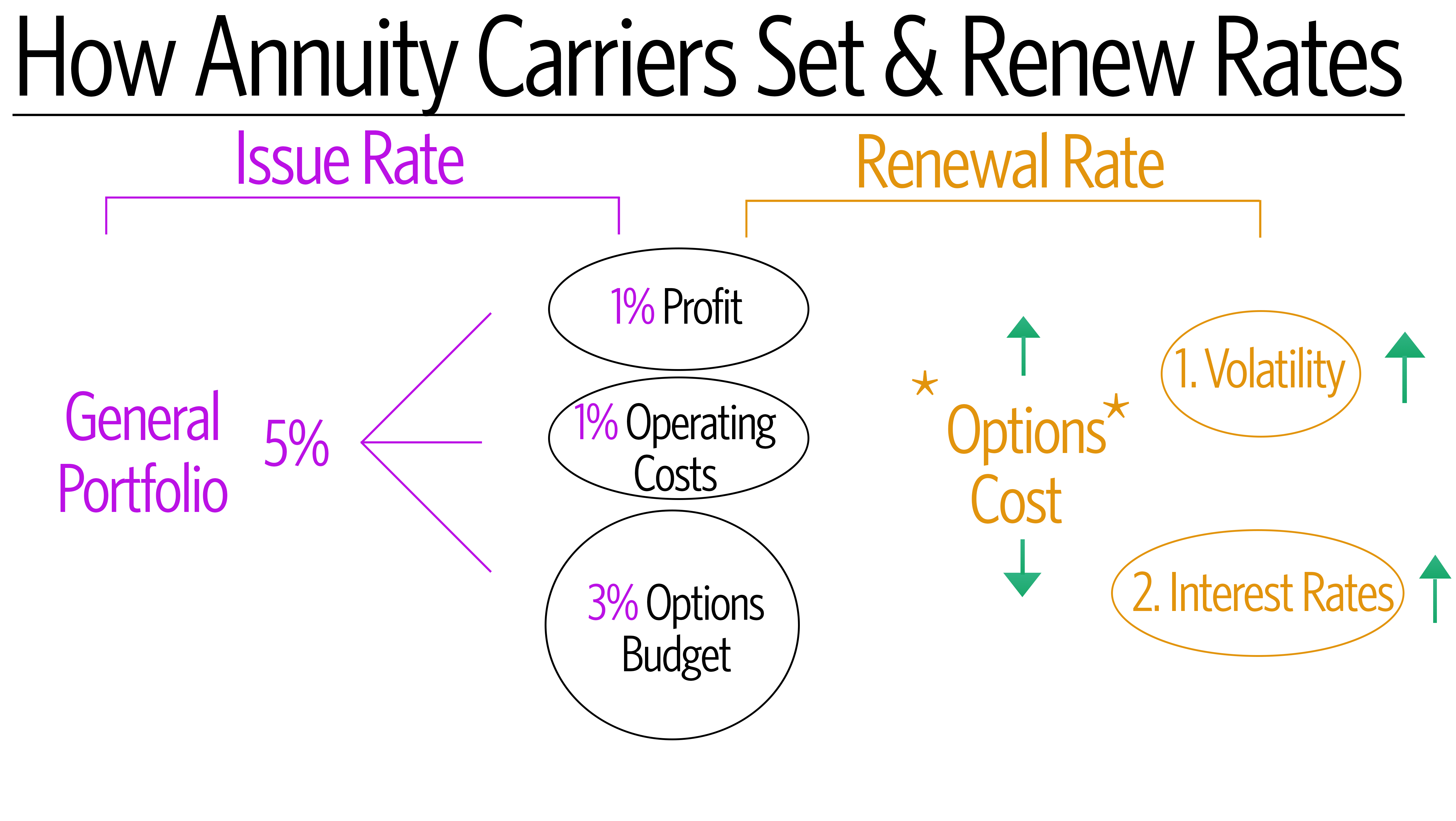

When you contribute money to a fixed index annuity, the carrier invests that premium into their general portfolio. This portfolio is packed with safe, highly rated bonds and fixed-income securities. These investments generally earn around 5%, which helps form the backbone of how the carrier sets your rates.

The carrier, like any business, takes a portion of that yield for themselves—usually around 1% for profit, and another 1% for operating costs. The remainder, about 3%, goes into something called the options budget. This budget is used to buy call options on a specific index, like the S&P 500, giving you the chance to earn positive index gains while avoiding negative volatility.

What About Those Caps?

Let’s say you’ve been quoted an 8% cap rate with a floor of 0%. This cap is based on how much the carrier’s general portfolio can sustain. If all conditions remain stable (interest rates, volatility, etc.), that cap could theoretically stay the same throughout the contract.

But here’s the catch—it doesn’t always stay the same.

Renewal Rates – The Next Chapter

When we move into years two and beyond, things get a little more complicated. The biggest factor determining whether your cap rate will change is something called the options cost. Simply put, the higher the cost of the options, the lower the cap, and vice versa. This cost is driven by two main factors: volatility and interest rates. Higher volatility or interest rates push up options costs, which can reduce the caps you’re offered during renewals.

To mitigate these risks, some carriers offer products with an “engineered volatility-controlled index.” This type of index is designed to minimize volatility and stabilize interest rates, giving you a more predictable renewal experience.

What to Look for in an Annuity Carrier

When working with a financial advisor, there are two key things to focus on:

- Carrier Reputation: Make sure the carrier has a strong financial standing, indicated by high COMDEX scores and AAA ratings.

- Renewal Rate History: Some carriers publish their renewal rate history, while others don’t. Ask your advisor to help you navigate this data to ensure you’re getting a good deal, not just in the first year but throughout the life of the annuity.

At the end of the day, annuities are powerful tools for safe accumulation, but understanding the mechanics behind rate-setting and renewals is key to making informed decisions. Thanks for reading, and I look forward to seeing you in the next episode.