Estimated reading time: 1 minute

Hello, and welcome to another edition of Money Script Monday. I’m Michael Clementi, and I want to extend my sincere thanks for joining us today. This week’s episode tackles an important question: “When Should I Take Risk?” It’s a topic that sparks a lot of debate, and for good reason—risk is a critical factor in financial planning.

People often ask, “When should I take risks? What’s the best strategy? What’s the best product?” The truth is, there isn’t a one-size-fits-all answer. There is, however, an answer for you. Today, we’re going to explore how to determine that answer based on where you are in life, what your goals are, and when it makes sense to take risks based on your financial journey. You’ll see that working with a financial advisor to make informed decisions is crucial.

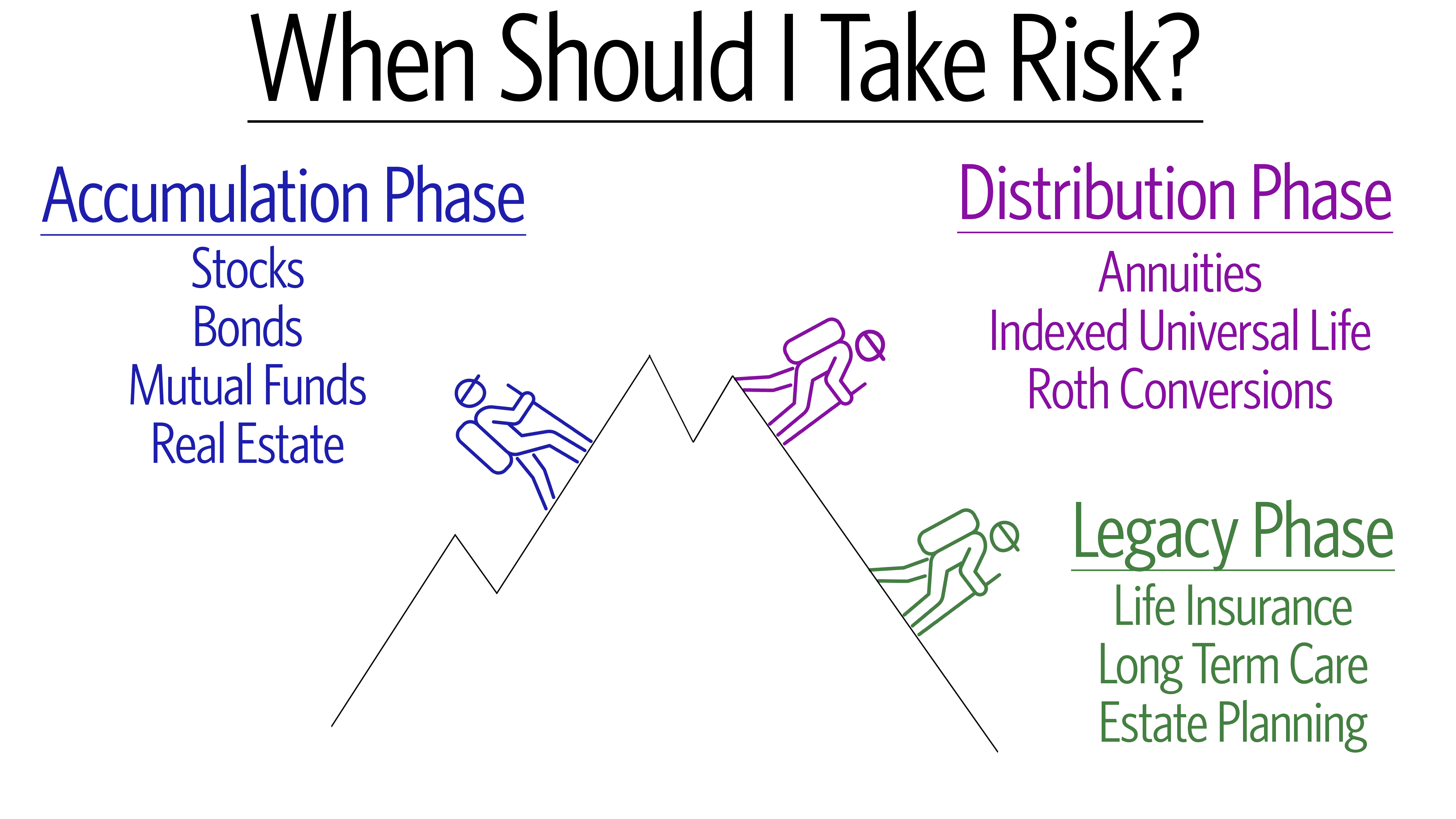

The Financial Mountain: A Journey to Success

Behind me is a mountain that represents Mount Everest, a symbol of both the financial journey and the road to retirement. This visual is important because climbing a mountain mirrors the ups and downs of financial planning. Interestingly, most climbers who have tragically lost their lives on Everest didn’t perish while climbing up; they died on the descent, having already reached the peak. This teaches us an important lesson: the journey back down—or, in financial terms, the journey through retirement—requires just as much caution and planning as the ascent. Taking on too much risk at the wrong time can derail even the best-laid plans.

The Accumulation Phase: Building Your Financial Foundation

Let’s start with the early part of your financial journey, typically between ages 30 and 40. This is often when you’re in your first major career, earning more than ever before, and focusing on saving.

A personal example from my own life: my wife and I bought our first home in Southern California in February 2024. Over the last five years, we set aside every bonus and lump sum of money. By being disciplined and saving, we not only moved out of an apartment but also invested in an asset that will appreciate over time—our home.

This period is what we call the accumulation phase, where your main goal is to build wealth. You’re taking bigger risks because you have more time until retirement. Whether you’re investing in stocks, bonds, mutual funds, or real estate, the aim is to grow your net worth and accumulate assets that can later provide financial security.

Working with a Money Manager

Once you’ve built some wealth, whether that’s tens of thousands or hundreds of thousands of dollars, it’s time to work with a money manager. This partnership helps you invest wisely in stocks, bonds, and mutual funds, but more importantly, it helps you figure out your retirement goals. You need a solid plan to ensure your wealth continues to grow and that your financial future is secure.

The Transition to Retirement: Shifting Risk

As you near retirement, somewhere between ages 60 and 65, the focus shifts. You want to keep more of what you’ve accumulated and ensure it lasts throughout retirement. This is where you start moving assets into lower-risk or even zero-risk accounts. Consider strategies like annuities and indexed universal life (IUL) insurance. These options can limit downside risk while guaranteeing income for the rest of your life.

- Annuities: Annuities can offer a guaranteed lifetime income, much like a pension or Social Security. This ensures that you and your spouse won’t outlive your retirement savings.

- Indexed Universal Life (IUL): In addition to providing a tax-free death benefit for your family, an IUL can help you access funds during retirement without tax implications. Plus, it protects your savings from market volatility.

The Legacy Phase: Planning for the Future

As you move into your later retirement years (around ages 75 to 80), it’s time to think about your legacy. You’ve enjoyed retirement, but now it’s crucial to protect what you’ve built. At this point, consider life insurance and long-term care plans to ensure your family isn’t financially burdened in the future.

Additionally, working with an estate planning attorney can help you create a clear plan for your heirs, eliminating confusion and stress when the time comes to transfer your estate.

There’s No “One Right Answer”

I want to emphasize that there’s no universal answer to “When should I take risk?” The right approach depends on your financial situation, goals, and where you are on your journey. The key is to work with a financial advisor who can help you create a plan tailored to your needs and ensure you never outlive your retirement savings.

Thank you for joining me today. I encourage you to reflect on what we’ve discussed and partner with a trusted advisor to map out your financial path. I’m Michael Clementi, and I look forward to seeing you next week for another episode of Money Script Monday.