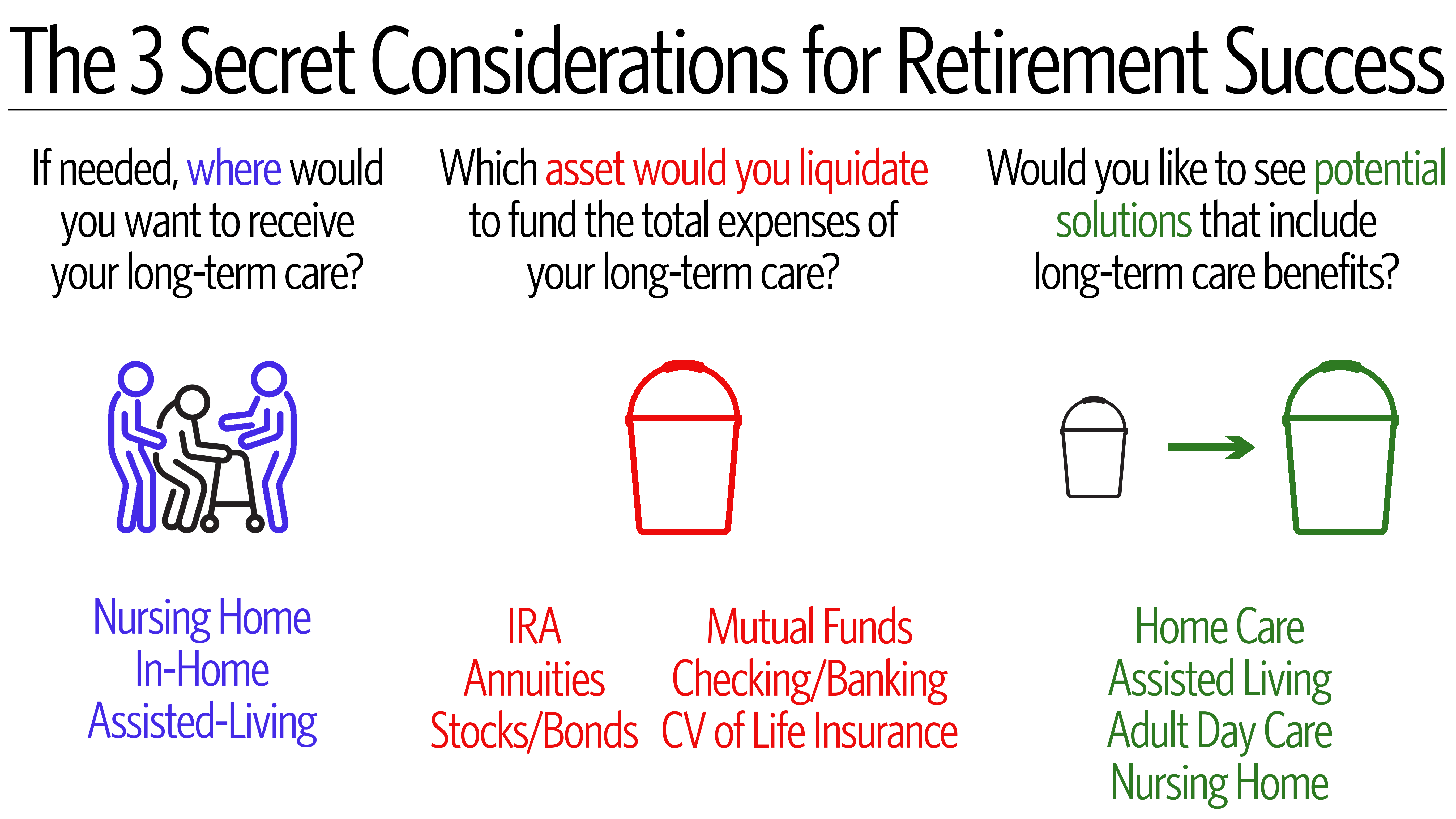

The 3 Secret Considerations for Retirement Success

Welcome back to Money Script Monday! My name is Sal Mendoza, and today, I want to share with you three crucial considerations for achieving retirement success. As a guest speaker for Divine Path Financial, I’m excited to connect with all of you and provide insights that are essential for securing your financial future and ensuring peace of mind during your retirement years.

A Personal Story: The Importance of Long-Term Care Planning

Before diving into the key considerations, I’d like to start with a personal story that highlights the importance of planning for long-term care. My mother was a remarkable woman who worked tirelessly throughout her life, raising four children on her own, including my brother, who required special assistance. Despite the immense demands on her time and energy, she managed to provide for all of us.

As my brothers and I grew older, we agreed that I would take on the responsibility of caring for her when the time came. However, that day never arrived. My mother lived a healthy life until the age of 93 when she suddenly passed away. While my experience is unique, the reality for many families is different.

In fact, 70% of Americans aged 65 and over will need some form of long-term care, with an average duration of at least three and a half years. A smaller percentage will require care for five years or more. Although many families are willing to step in and provide care, this isn’t always the ideal or feasible solution. This leads us to the three secret considerations for retirement success.

Consideration #1: Where Would You Prefer to Receive Long-Term Care?

One of the first questions you need to ask yourself is where you would prefer to receive long-term care. Your options typically include a nursing home, in-home care, or assisted living. For example, in California, in-home care costs around $73,000 per year, assisted living is approximately $63,000 per year, and nursing home care can be as much as $111,000 per year.

These costs can quickly deplete your savings if you haven’t planned for them. Deciding on the type of care you prefer and understanding the associated costs is a critical first step in your retirement planning.

Consideration #2: Which Assets Would You Liquidate to Cover Long-Term Care Costs?

The second consideration is which assets you would liquidate to cover these costs. Imagine all your assets being in a large red bucket—this bucket contains your IRA, annuities, stocks, bonds, mutual funds, checking, savings, and cash value life insurance.

One effective strategy is to consider using and liquidating your IRA, particularly because of the Pension Protection Act. This act allows you to move your IRA funds into long-term care insurance, with benefits that are tax-free if used for long-term care. Additionally, if you don’t end up needing these benefits, the funds pass to your beneficiaries tax-free.

Consideration #3: Are You Interested in Solutions That Include Long-Term Care Benefits?

The final consideration is whether you’re interested in solutions that include long-term care benefits. Imagine if you could pay only 25 cents on the dollar for long-term care expenses instead of paying dollar for dollar. This could represent a 75% savings—a significant reduction in potential costs.

By planning today, you can see how this approach could impact your retirement strategy and ensure that you’re prepared for any eventuality. Moreover, this type of planning can provide a monthly benefit for you and your spouse that will pay indefinitely, even including inflation increases if desired. This ensures that you have the preferred care, whether it’s in-home care or assisted living.

Conclusion: Take Action Today

I encourage you to reach out to your financial advisor and ask for a free, personalized long-term care illustration. This will help you understand how you can plan effectively and make informed decisions about your retirement. Thinking ahead can unlock potential benefits and provide you with the security you need.

Thank you for joining me on this Money Script Monday. I hope these three considerations help you as you plan for a secure and successful retirement. My name is Sal Mendoza, and I’m honored to be part of your journey with Divine Path Financial.